Starting on January 1, 2022, the following employment laws take effect.

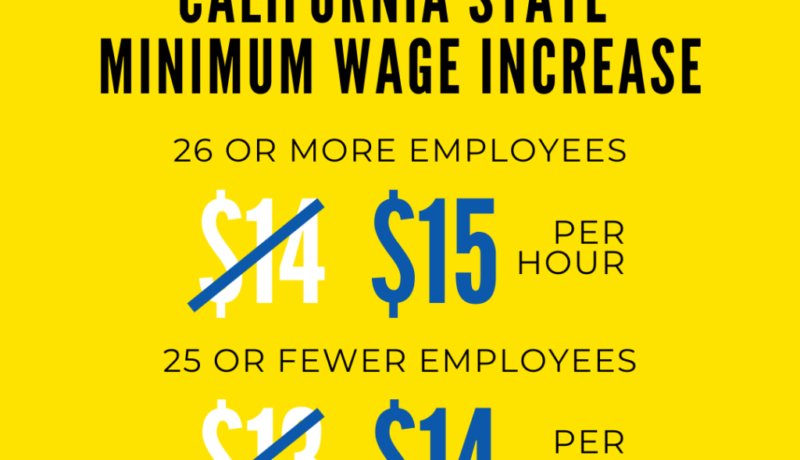

Reminder – Increase in Minimum Wage in California

Effective on and after January 1, 2022, minimum wage for California workers increases to $15.00 per hour for employers with 26 or more employees and to $14.00 per hour for employers with 25 or fewer employees. Employers should continue to monitor local minimum wage requirements as well. These amounts also affect the minimum salary requirements for exempt employees. (The City of Los Angeles, minimum wage is $15.00 per hour regardless of the employer’s size.) The minimum wage in Lomita is not a City enacted mandate and therefore follows the state-enacted minimum wage mandate.

California Family Rights Act Clean Up Bill

The California Family Rights Act (CFRA) was expanded last year to cover small employers and dramatically broadened the definition of “family member” for whom leave could be taken. AB 1033 builds upon last year’s SB 1383 and clarifies that employees can take family and medical leave to care for a parent-in-law with a serious health condition. AB 1033 also makes participation in a mediation program (under AB 1867) a prerequisite to an employee filing a civil action. Good news for small businesses to know that CFRA disputes can be resolved through mediation rather than costly litigation.

Cal/OSHA Enforcement Authority

SB 606 – Expands Cal/OSHA’s enforcement authority. Cal/OSHA can issue citations for two new violations categories.

If an employer with multiple worksites has a written policy or procedure in violation of certain safety rules or evidence of an unsafe pattern or practice, Cal/OSHA may presume that the violation is enterprise-wide. If the employer fails to rebut the presumption, Cal/OSHA may issue an enterprise-wide citation (carrying the same penalties as repeated or willful violations) requiring abatement.

If Cal/OSHA believes an employer has egregiously or willfully violated an occupational health or safety standard, special order, or regulations as noted in the statute, Cal/OSHA must issue a citation for an “egregious violation.” SB 606 specifies that every instance of an employee exposed to an egregious volition is considered a separate violation when issuing fines and penalties.

Wages

Under AB 1003 the intentional theft of wages, benefits or compensation of more than $950 for one employee or more than $2,350 for two or more employees in a consecutive 12-month period is punishable as grand theft under the California Penal Code (prosecutors may charge as a misdemeanor or felony).

SB 572 allows the California Labor Commissioner to enforce wage liens against employers by being able to create a lien on real property, as an alternative to a judgment lien, in order to secure amounts due to the commissioner under any final citation, findings or decision.

Severance & Settlement Agreements

SB 331 significantly expands on laws passed over the past few years limiting the ability to use confidentiality clauses in severance and settlement agreements. Prior to SB 331, any settlement agreement in a case where sexual harassment, sexual assault or discrimination based on sex has been alleged couldn’t include a confidentiality provision prohibiting disclosure of information regarding the claim.

SB 331 will apply to settlement agreements starting January 1, 2022. A severance and settlement agreement in a case of discrimination based on sex, sexual harassment, or sexual assault has been alleged cannot include a confidentiality provision prohibiting disclosure of information regarding the claim. SB 331 expands this prohibition to include other acts of workplace harassment or discrimination, not just those based on sex based on any characteristic protected under the Fair Employment and Housing Act. Employers can still include clauses preventing disclosure of the claims settlement amount paid. However, employees cannot be prohibited from discussing underlying facts of the case.

COVID-19

AB 654 is an urgency measure that took effect immediately upon signing on October 5. It clarifies last year’s COVID-19 bill (AB 685) to make notice requirements and reporting more consistent. Specifically, regarding the obligations to provide information on COVID-19-related benefits and the disinfection and safety information, the language was revised to require employers to send notice to employees who were “on the premises at the same worksite as the qualifying individual within the infectious period.” The bill also changes the timeframe for employers to notify local public health agencies of COVID-19 outbreaks to “within 48 hours or one business day, whichever is later.” It exempts those health facilities already required to report outbreaks under other legal requirements.

When the California Department of Public Health (CDPH) or a local health officer issues an order or mandatory COVID-19-related guidance, they’re required under SB 336 to publish the order/guidance on their website and date it takes effect. The CDPH or local health officer must also provide an opportunity to sign up to receive updates regarding the order or guidance via email.

Personal Protective Equipment (PPE) State Stockpile Expanded

Under AB 73, last year’s personal protective equipment (PPE) bill was broadened to include agricultural workers as essential workers as well as wildfire smoke events as a health emergency under the law. AB 73 also requires Cal/OSHA to update wildfire smoke training, which employers must follow.

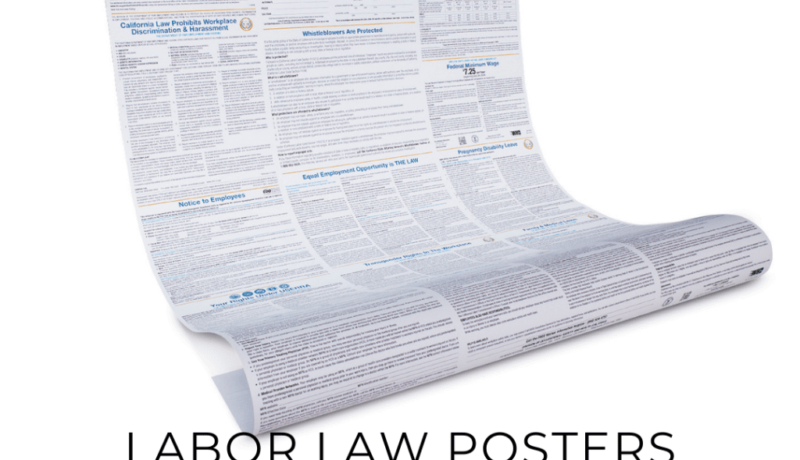

California & Federal Labor Law Posters Required For Facilities and Remote Employees (SB 657)

Every California employer must physically post current a California and Federal Labor Law Poster at each company facility. If a business doesn’t display a current poster, the business may be subject to severe fines and penalties.

In addition to the physical posting requirement, companies that have employees that work 100% from home and never report to a headquarters or location, hard copies of mandatory employment notices should be mailed to the employees homes, where they can be posted.

Under Senate Bill 657 (SB657), it is not sufficient to simply email the required notices to remote employees. For remote workers, the physical posting requirement applies to the employee’s home. The employer needs to send required notices to remote workers, direct the remote worker to print and post the notices, and reimburse for any expenses incurred by the employee to do so.

Posters may be purchased through CalChamber.

(Note: posters will not be shipped from CalChamber until early January since they’re awaiting final information from government agencies on two of the required employment notices.)

Employers should consult with legal counsel to make any changes to their policies and procedures as it relates to these latest laws.

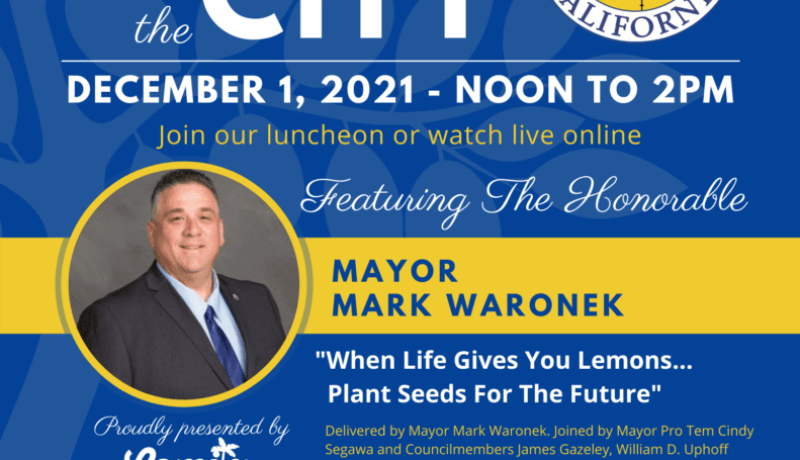

Lemonade Day Lomita 2021 Bri’s Frozen LemonadesOn Saturday August 7th, the Lomita Chamber of Commerce in partnership with the City of Lomita presented the first annual Lemonade Day Lomita event. The city overflowed with 37 lemonade stands open at local businesses and locations throughout the community. Brianna Garcia was one of 60 young entrepreneurs who made the commitment to start and run a lemonade stand for a real-life entrepreneurial experience.

Lemonade Day Lomita 2021 Bri’s Frozen LemonadesOn Saturday August 7th, the Lomita Chamber of Commerce in partnership with the City of Lomita presented the first annual Lemonade Day Lomita event. The city overflowed with 37 lemonade stands open at local businesses and locations throughout the community. Brianna Garcia was one of 60 young entrepreneurs who made the commitment to start and run a lemonade stand for a real-life entrepreneurial experience. Brianna worked alongside her mentor Bonnie Orona from Adam’s Chiropractic & Wellness Center who helped her gain the necessary tools and skills needed to open her small business. Brianna was thrilled with the turnout, “I was so amazed at all the people that came to my stand. I sold over 200 cups of lemonade! I had so many of my family, friends, neighbors, and patients from Adam Chiropractic come to my stand.”

Brianna worked alongside her mentor Bonnie Orona from Adam’s Chiropractic & Wellness Center who helped her gain the necessary tools and skills needed to open her small business. Brianna was thrilled with the turnout, “I was so amazed at all the people that came to my stand. I sold over 200 cups of lemonade! I had so many of my family, friends, neighbors, and patients from Adam Chiropractic come to my stand.” In early October, Brianna posted on social media (@brisfrozenlemonades) giving thanks and love for all the support she received from family, friends, and the community as she was named the 2021 National Youth Entrepreneur of the Year. Lemonade Day National will fly Brianna and her father to Houston, Texas for Brianna’s award presentation and to share her experience with the Lemonade Day National Board.

In early October, Brianna posted on social media (@brisfrozenlemonades) giving thanks and love for all the support she received from family, friends, and the community as she was named the 2021 National Youth Entrepreneur of the Year. Lemonade Day National will fly Brianna and her father to Houston, Texas for Brianna’s award presentation and to share her experience with the Lemonade Day National Board.